commercial property investment

# don't invest in commercial properties without an expert commercial agent

So, the Level of Risk for your investment is the critical factor that will finally turn your thought to an actual investment, and for that you surely need a commercial agent with financial and investment knowledge background.

The Property-Io Commercial Real Estate Dpmt

things to consider

# commercial investing success lies in hard and quality work

1. A hardcore investment-nature option

It is a totally different choice, option and perspective than a classic residential property investment. Commercial Property is a hardcore money investment and as that you should see it. Most people get confused or are misled by non-professional real estate agents and end up in spending huge amounts of money to properties that finally are not only far from their initial expectation, but also may prove catastrophic.

2. A long term and possibly an irreversible decision

If something is for sure is that buying a commercial real estate property isn’t a short-term option. If you expect or anticipate high yields and returns in the short run, you should reject the option of commercial investing. This applies also to short tail resell-option byers and speculators. Commercial Properties have inherently a long horizon profit return and added value gain.

3. Lease Income or Growth Value?

How do you expect or how you have thought on investing in a commercial property or building? Are you counting on steady monthly commercial lease income? Or you expecting a future, mid or long term growth on the location or the property itself? Clarifying this as your initial goal will help you in assessing correctly all the specific data of your selected commercial property.

# property-io luxury real estate

OUR TEAM IS HERE TO ANSWER YOUR QUESTIONS

CONTACT US TODAY AND WE WILL REPLY WITHIN 24 HOURS

things to consider

# commercial investing success lies in hard and quality work

4. Parallel Factors / Usage

An equally critical factor in your choice but at the same time an always tailored and personal factor of choice is what you plan to do with your commercial investment. Are you going to build a plant operation? Are you going to set up a pick-up/warehouse service? Are you going to use it as an industrial warehouse? Are you going to build a mall, a hotel or operate any type of business? Then, personal factors might apply, which under the smooth co-operation with an expert commercial real estate agent might play significant role in the price and the location that will finally be selected.

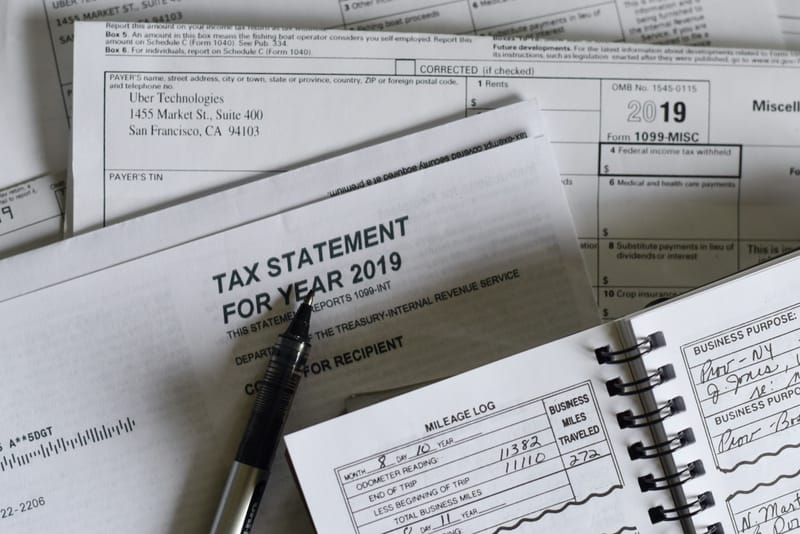

5. Taxation / Legislation Framework-Restrictions-Motives

Although it seems needless to state, our experience has shown that many times investors, whereas the huge amounts they spend on buying commercial properties they neglect important taxation and/or legislative factors that might play significant role in the value/return of their investment or in the full usage of it in the long run.

6. Location / Infrastructure Analysis

Along with an expert commercial agent, before investing in a commercial property or building or land you should conduct a detailed contingency plan on the location of the property and its corresponding current or future infrastructure. What is your specific commercial property’s location analysis? What’s the infrastructure of the area? How are the surrounding buildings, properties or lands affecting your investment? What about the status of parking, drivers and commuters? What are the market projection trends of the specific area? What is the income level of the area? How far or close it is from the center of the town? Are there any environmental factors or restrictions to consider?

don't act for your investment; pro-act!

# property-io commercial properties department

things to consider

# commercial investment success lies in thorough contingency plans

7. Actual Condition of the Property

Along with an expert commercial agent, before investing in a commercial property, building or land you should always conduct a detailed contingency plan of the property’s location and its corresponding current or future infrastructure state. For example, is the property ready for rent, usage and business operations? If no, what’s the time and the capital it is needed to become fully active? What’s its wear and tear from its latest usage? In the current condition of the commercial property lies what we call the hidden cost, so it’s crucial that you know and can accurately assess that with a prolific commercial real estate agent.

8. Earnest Money

After examining all these factors and if everything rolls smoothly, you will be asked for a down-payment to close the deal, as a good faith sign that you are serious about actually buying the property. The percentage of the down-payment is typically between 1% and 3% of the actual sale price and most times it is held as an escrow if the buyer backs out. Under the normal course of things it will be subtracted upon the final full payment. Another thing to check is the time-duration of the down-payment, because in most cases there is a limited time clause for the completion of the full deal between the two parts, otherwise the down-payment cannot be returned to the potential buyer.